MoneyZG – Crypto Investor Course 2023

Free Download MoneyZG – Crypto Investor Course Download 2023

What You Get:

Learn vital trading and investing lessons like:

CRYPTO

- Crypto types: store of value

- Crypto types: smart contracts

- Crypto types: exchange tokens

- Crypto types: oracles

- Crypto types: payments

- Crypto types: stablecoins

- Crypto types: privacy coins

- Crypto types: meme coins

- Crypto types: wrapped tokens

- Crypto types: LP tokens

- Token standards explained [ERC-20]

- Staking your crypto

- The blockchain trilemma

- Don't focus on TPS!!

- Bitcoin: The Asset Class

TOKENOMICS

- Price vs market cap

- Coin vs token

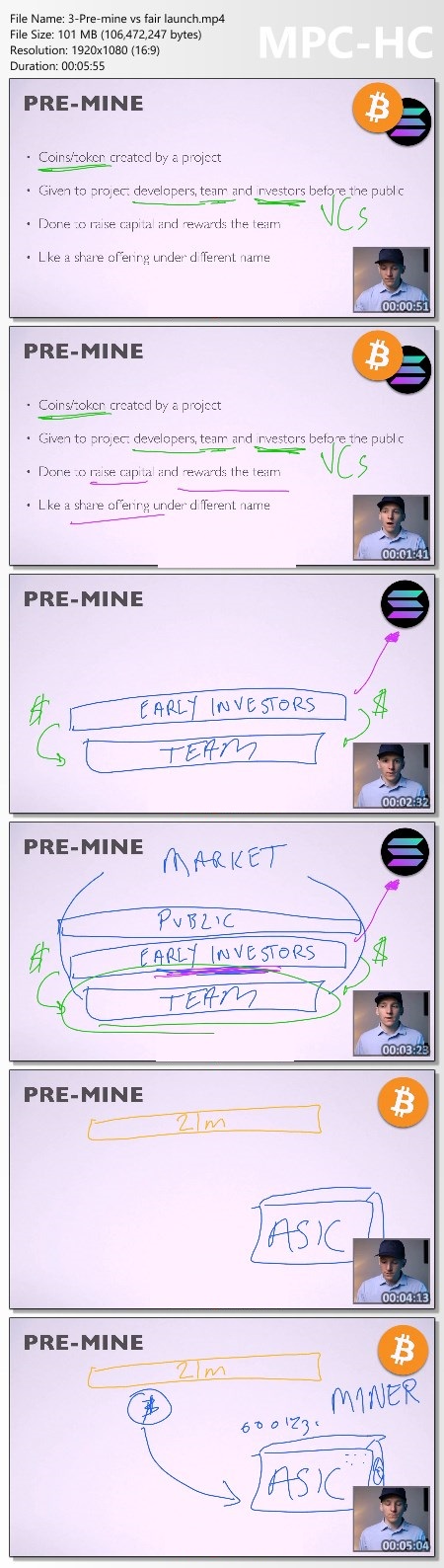

- Pre-mine vs fair launch

- ICOs

- Circulating vs total supply

- Inflation

- Token burns

- Tokenomics research: ADA

- Tokenomics research: BTC

- What are "good tokenomics"?

- Valuing DAPP tokens

- Valuing tokens: important considerations

ON-CHAIN

- What is on-chain analysis?

- How to use a blockchain explorer

- Top HODLers

- Staking rates

- Exchange flows

- Stablecoin ratios

- Funding rates

- HODL waves

- Hashrate, validators and nodes

- #1 MOST important on-chain data!

DYOR

- Step 1: understand the market

- Step 2: understand the economics

- Step 3: going deep

- Step 4: keeping up to date

TRADING

- Currency pairs: base vs quote

- Currency pairs: cross pairs

- Order book explained

- Maker vs taker explained

- Order types: market order

- Order types: limit order

- Order types: iceberg order

- Order types: stops [SL/TP]

- Candlestick charts explained

- Candlestick patterns: hammer

- Candlestick patterns: shooting star

- Candlestick patterns: bullish engulfing

- Candlestick patterns: bearish engulfing

- Chart patterns: double top

- Chart patterns: double bottom

- Trends: ascending wedge

- Trends: descending wedge

- Trends: higher highs

- Trends: lower lows

- Trends: support and resistance

- Trends: consolidation

- EASY way to read charts: moving averages

- How to draw trends lines

- Metrics: ATR

- Metrics: MACD

- Finding areas of value

- Key tips for trading with candles

- Day trading strategy: find the trend

- Day trading strategy: find the price action

- Day trading strategy: get your entry/exit

- Day trading strategy: managing your trade

- Trading bots: grid bot

- Tradings bots: spot/futures arbitrage

NFTs

- Fungible vs non-fungible tokens

- NFT token standards

- How NFTs work

- The value proposition of NFTs

- How NFTs drop

- NFT buying guide

- BEWARE of these NFT pitfalls

WALLETS

- Crypto wallet basics

- Crypto wallet addresses

- Wallet security

- Hot wallets vs cold wallets

- Using MetaMask

DEFI

- 3 ways to earn crypto passive income

- DeFi vs CeFi

- Here's the DeFi platforms I use

- The yield curve and crypto

- How to calculate compound interest

- The REAL rate of return

- Getting EXTRA yields

- Lending: risks to know

- Borrowing part 1: collateral

- Borrowing part 2: Loan To Value

- Borrowing part 3: liquidation penalty

- DeXs explained

- DeXs: Order book vs AMM markets

- Liquidity pools explained

- DeX live training: how to swap & add liquidity

- Divergence loss could destroy your gains

- Divergence loss calculator & tips!!

- An intro to yield farming

INVESTING

- Growth vs value investing

- Which type of investor are you?

- Paying off debt vs investing

- 60/40 is dead

- Risk vs volatility

- Becoming diversified

- Standard deviation

- Sharpe ratio

- Bitcoin & Beta

- CAPM

- How to make subjective calls on risk

PORTFOLIO

- My low risk crypto types

- My medium risk crypto types

- My high risk crypto types

- Dollar cost averaging

- Step 1: outcomes

- Step 2: asset allocation

- Step 3: sector allocation

- My portfolio

- Compounding: the KEY to building wealth!

- Why I consistently invest in growth

- Re-balancing a portfolio

CONSUMER GUIDES

- CoinTracking

- CoinLedger

- Koinly

- Crypto.com Tax

- CoinMarketCap

OPTIONS

- Intro to Derivatives

- Options Basics

- Options: Calls vs Puts

- Options Premiums

- Valuing Options Premiums

- Call Option Example

- Put Option Example

- Long Call P&L

- Short Call P&L

- Long Put P&L

- Short Put P&L

- Covered Calls

- Writing Puts

- Options Recap

- Options Strategies: Intro

- Options Strategies: Long Calls

- Options Strategies: Naked Short Call

- Options Strategies: Covered Calls

- Options Strategies: Long Puts

- Options Strategies: Naked Short Puts

- Options Strategies: Protective Puts

- Options Strategies: Bull Call Spreads

- Options Strategies: Bear Put Spreads

- Options Strategies: Long Straddle

FUTURES

- Crypto Margin Accounts

- Crypto Margin Calculation

- Using Crypto Margin Accounts

- Crypto Futures: Introduction

- Futures vs Spot Trading Screens

- What is Futures Funding?

- USD-Margined vs Coin-Margined Futures

- How Traders Use Leverage

- The Liquidation Calculation

- Order Types: Reduce Only

- Order Types: Post Only

- You MUST Use a TP/SL

- Stop Loss: Percent Strategy

- Stop Loss: Trailing SL Strategy

- Stop Loss: Support/Resistance Strategy

- Stop Loss: Moving Average Strategy

- Stop Loss: ATR Strategy

- Position Size Calculation

- Leverage & Liquidations

- How to Scale Positions

- Changing R

- Win Rates & KEY Data

UPDATES & RESEARCH

- Monolithic vs Modular Chains [March 2022]

- ETH Scaling Solutions [March 2022]

- Zero Knowledge Proofs [March 2022]

- Optimistic vs ZK Rollups [March 2022]

- STARK vs SNARK vs Plonk [March 2022]

- Starknet L2 Update [March 2022]

- Monolithic vs Modular Cont. [March 2022]

- State of the Market [March 2022]

Sales Page:

https://moneyzg.academy/

Screenshots

Rapidgator-->Click Link PeepLink Below Here Contains Rapidgator

http://peeplink.in/f90c49e50940

PeepLink Password: 123

Uploadgig

MoneyZG.Crypto.Investor.Course.Download.part1.rar

MoneyZG.Crypto.Investor.Course.Download.part2.rar

MoneyZG.Crypto.Investor.Course.Download.part3.rar

MoneyZG.Crypto.Investor.Course.Download.part4.rar

MoneyZG.Crypto.Investor.Course.Download.part5.rar

MoneyZG.Crypto.Investor.Course.Download.part6.rar

NitroFlare

MoneyZG.Crypto.Investor.Course.Download.part1.rar

MoneyZG.Crypto.Investor.Course.Download.part2.rar

MoneyZG.Crypto.Investor.Course.Download.part3.rar

MoneyZG.Crypto.Investor.Course.Download.part4.rar

MoneyZG.Crypto.Investor.Course.Download.part5.rar

MoneyZG.Crypto.Investor.Course.Download.part6.rar

Links are Interchangeable - Single Extraction